Every day during January 2018, 27.5 million plastic card purchase transactions took place in the UK, totalling £1.361 billion.

This equates to an average of 319 debit and credit card purchases every second. In February 2018 alone, the average UK adult borrowed £4,235. This figure included unsecured loans, overdrafts, retail and motor finance, and credit cards. Total credit card debt for the month was £55.3 billion.

Many UK residents are unable to manage their debt, with someone declaring bankruptcy or insolvency every four minutes and 32 seconds.

If you are struggling with credit card debt and juggling cards around or robbing peter to pay paul to keep them up to debt contact us for a debt solution that can help you consolidate them all into one single affordable repayment. We can guide you through all the best debt solutions to help you.

⏱ Get A Free No Obligation Debt Assessment:

Please fill out this form and we will get in touch with you shortly.

These statistics from Credit Action indicate the severity of the credit card debt issue in the UK. According to the former Association for Payment Clearing Services, there are more credit cards circulating in the UK than there are residents. Approximately 14 million Brits use credit cards to make regular purchases, leading many into financial decline when they charge too much, miss payments, or pay their bills late.

The cost of the purchase becomes much higher than the price of the product or service itself. When consumers begin struggling with unsecured credit card debt, they should immediately seek help.

Ways to Handle Credit Card Debt

In some cases, reorganizing the personal budget may be all it takes to manage credit card debt. By reducing other expenses, some consumers free enough cash to quickly repay their credit card bills. Others are able to obtain another card with a limited time zero percent interest rate on balance transfers.

By transferring balances from high-interest cards to the new card, consumers prevent interest from accruing as long as the new balance is repaid within the introductory period.

Not everyone is able to eliminate credit card debt this way and a debt management professional can explain alternatives. The amount of credit card and other unsecured debt determines which solution is best. The three most common debt management tools for handling credit card debt are the Debt Management Plan (DMP), Individual Voluntary Arrangement (IVA), and debt relief order (DRO).

DMP

An informal debt management plan is managed by an experienced debt management company. The company arranges for the debtor to pay a set amount to each creditor monthly, with the goal of repaying all credit card debts in full. The debtor makes a single monthly payment to the debt management company that covers all debts and the company distributes the money to each creditor, per the agreement.

Creditors are not obligated to agree to a debt management plan but many do because they believe it is the only way they will receive full repayment.

When looking for a debt management company, be aware that some organizations charge a fee for their services. Finding an experienced organization that offers free, impartial advice is recommended. This allows consumers to understand the severity of their credit card debt and identify the best solution.

With a skilled professional in their corner, consumers can be confident that they will quickly get on the right track.

IVA

The governmental IVA program is a legally binding agreement to repay a reduced amount of debt. The remaining qualifying debt is written off when the IVA period ends. Consumers with a steady income who owe at least £12,000 may qualify for this program.

An IVA is similar to a debt management plan in that a repayment amount is negotiated with each creditor and the creditor makes a single monthly payment to cover all debts. However, an Insolvency Practitioner does the negotiating and allocates the payment to creditors.

The repayment amount is limited only by the financial circumstances of the debtor. When an IVA is in force, creditors may not take further action and they may even agree to freeze interest and other charges. An IVA typically lasts for five years and two fees are imposed that reduce the amount that creditors receive from the debtor.

The company supplying the Insolvency Practitioner may charge a third fee, so consumers should inquire about this.

DRO

A DRO is a formal arrangement created by the Insolvency Service as a more affordable bankruptcy alternative. Low income consumers who cannot repay their qualifying debts totaling less than £15,000 receive a one-year amnesty from repayment under a DRO, during which creditors may not take any action.

After that time, the covered debts are written off and the individual starts fresh. A DRO includes restrictions that apply to the creditor for the subsequent two to 15 years.

Consumers can only apply for a DRO online through an authorized third-party debt adviser called an intermediary. The filing cost is £90 and may be paid in installments. Before applying for a DRO, consumers with credit card debt should contact us.

Our professionals will verify whether the DRO is an option and will help with securing an intermediary and completing the application. We will also explain the various restrictions with which the debtor must comply.

There are advantages and disadvantages to each of these debt management solutions. Therefore, it is important for consumers to be fully informed before they take action. Being faced with unexpected restrictions or other surprises will only add to the frustration of being in debt.

Our debt management experts can explain the positive and negative aspects of each tool and help consumers identify the option most suitable for their situation.

What sets our representatives apart is the objective nature of their advice. They give each solution equal time and never push consumers to select an option. The person in debt makes the decision and there is no pressure to pick one suitable program over another.

We know that in order for a solution to be successful, the consumer must feel comfortable with it. The choice is yours…we just provide the information.

Anyone falling behind with credit card payments should seek professional advice immediately. Addressing the situation now makes things less painful than waiting until credit card balances increase even more. Read our site for more information about the various ways to manage credit card debt and then contact us so we can help you get started.

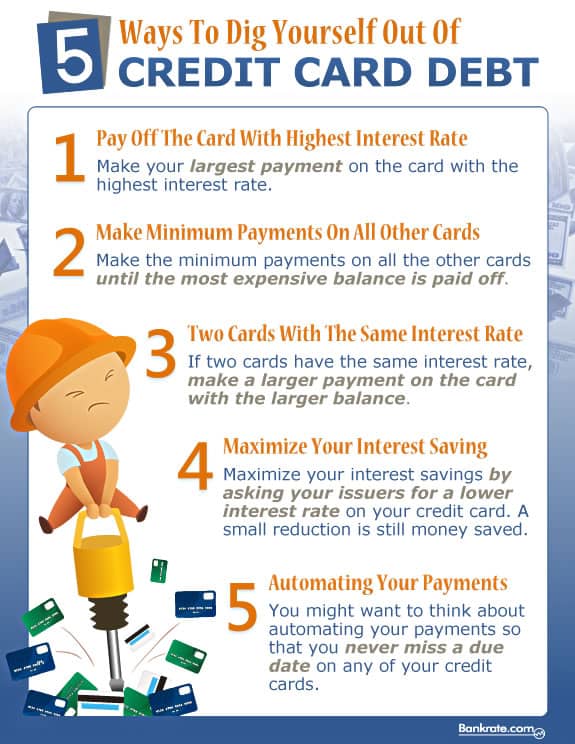

Great Ways To Get Out Of Card Debt Infographic

Courtesy: http://www.bankrate.com/